Frequently Asked Questions

Where are Bybit's servers located?

AWS Singapore, Availability Zone ID apse1-az2 & az3.

What should I be using – WebSocket or REST API?

If you're not sure what the difference between these two is or you find WebSockets confusing, please read: REST API vs WebSockets vs WebSocket API

reduceOnly and closeOnTrigger – what's the difference?

- To close your position, submit an order and specify

reduceOnlyto true.closeOnTriggeris not strictly applicable here, but you can also set it to true if it's required. - reduceOnly is the one that really matters for closing position, and we will improve the interface in the future.

- Be careful when you specify closeOnTrigger to true as it could cause conflict when reduceOnly is false.

Why I get 10003 API key is invalid?

The most likely cause is that the key used does not match the domain name:

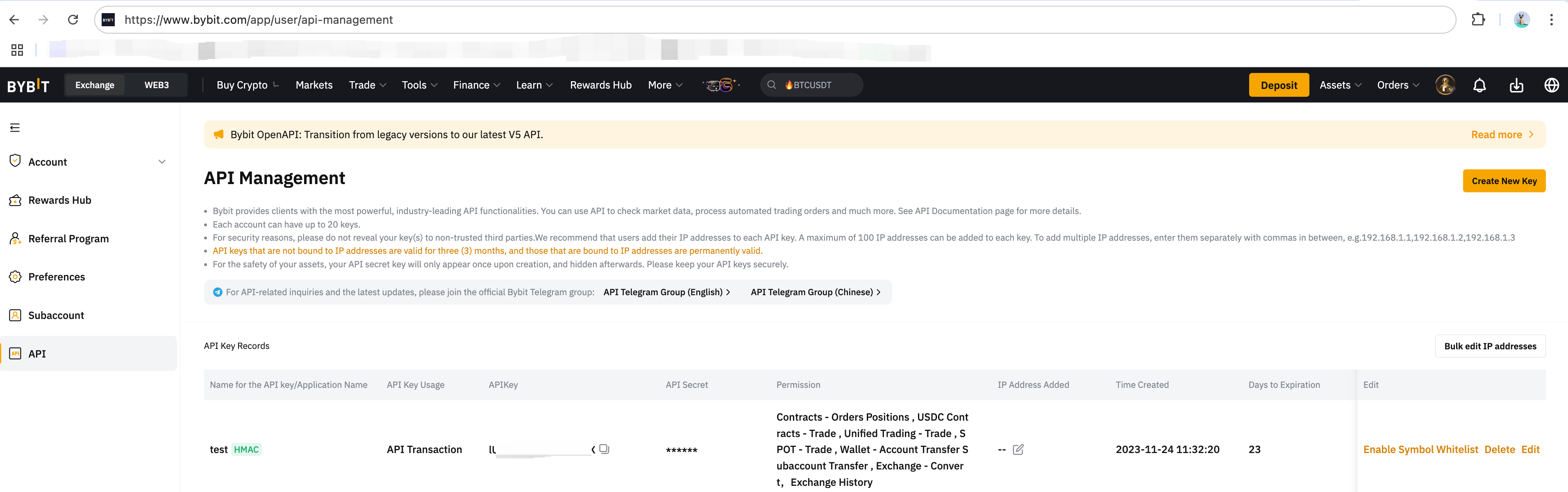

a. When request to api.bybit.com or stream.bybit.com, make sure the API key is created from Production

# pybit example

session = HTTP(

testnet=False,

api_key="xxxxxxxxxxxxxxxxxx",

api_secret="xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx",

)

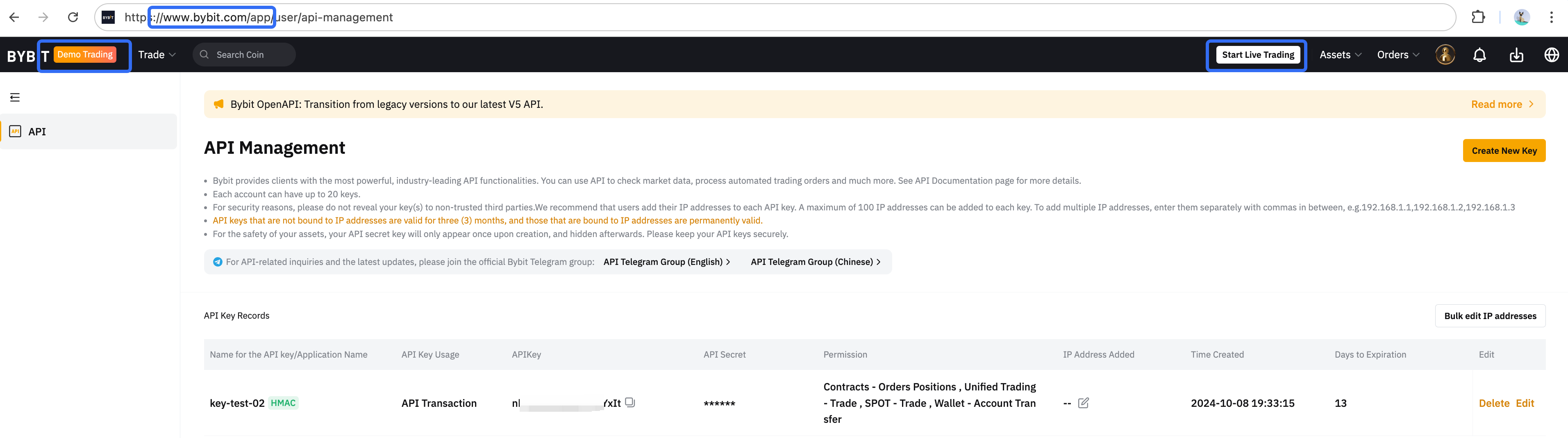

b. When request to api-demo.bybit.com or stream-demo.bybit.com, make sure the API key is created from Production – while in Demo Trading mode

# pybit example

session = HTTP(

testnet=False,

demo=True,

api_key="xxxxxxxxxxxxxxxxxx",

api_secret="xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx",

)

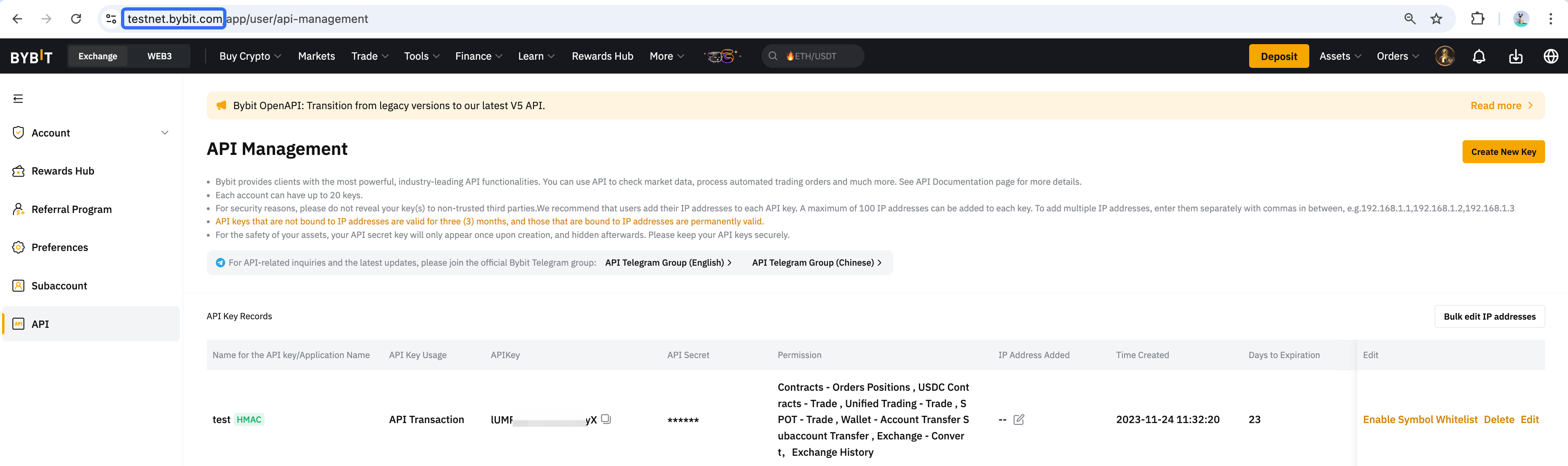

c. When request to api-testnet.bybit.com or stream-testnet.bybit.com, make sure the API key is created from Testnet – while outside of Demo Trading mode

# pybit example

session = HTTP(

testnet=True,

demo=False,

api_key="xxxxxxxxxxxxxxxxxx",

api_secret="xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx",

)

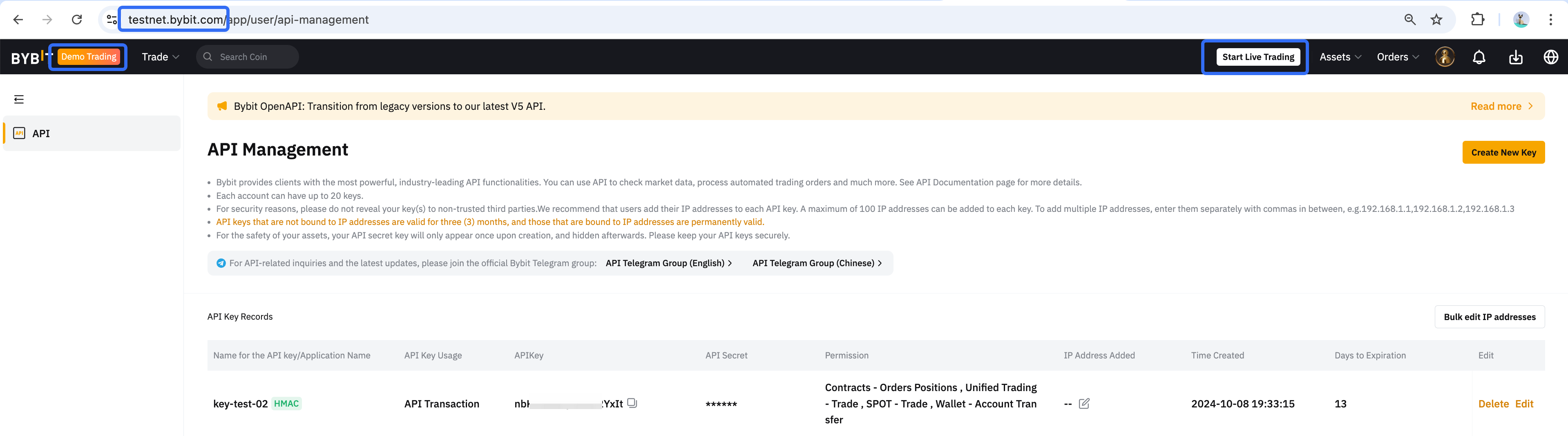

d. Do not use Demo Trading on Testnet. It is not recommended and can lead to unexpected outcomes. It also inherits limitations of both Testnet and Demo Trading.

Why aren't all my orders showing on the website?

- Users who have bots which place large numbers of laddered orders will be restricted by the frontend interface, which only shows a maximum of 50 orders on-screen.

- Don't worry, your orders are still in the system and can be queried by the API, but the frontend cannot show more than 50.

Can I exchange assets with the API?

Yes, convert API, but currently there is no API to convert small balances to MNT

Can I crypto loan with the API?

Yes, crypto loan API

How do I get funds for testnet?

To get testnet funds, just go to master account asset page to request.

Why are my Closed PNL prices inaccurate?

- The

entryPriceandexitPricereturned by Closed PNL endpoints are not the actual execution prices of the orders. - It is based on the total costs of the order (whether or not the position was only opened/closed by one order executed at one price – it is more complicated if multiple orders opened/closed a position.)

- For instance, the

entryPriceandexitPricereported by this endpoint are influenced by the fee paid/received on the orders.

How can I ensure I am using up-to-date data?

- It is possible, although unlikely, that the REST API or (even less likely) the websocket could return/push old data.

- For the greatest level of data resilience, we recommend clients to:

- firstly, rely on the websocket, which will not only ensure you get the latest data as fast as possible, but will also ensure you get complete data

- secondly, query the REST API to fill in any discrepencies in data – or between websocket disconnections.

- The best practice is to save all of this data locally in your own database or cache.

- This frees up your rate limits for other requests and also ensures a level of redundancy against the exchange in case of data delays.

What is the difference between turnover and volume?

Turnover: is in the opposite currency to the quantity's currency (like USDT in BTCUSDT)Volume: is in the same currency as the quantity's currency (like BTC in BTCUSDT)

Why is the price returned in the place market order response wrong?

Market orders are (in the backend) just limit orders submitted at a worse price. This is to reduce the chance of a flash crash or a similar event, where a trader might submit a market order which executes at a significantly worse price than they expected it to. The price returned here is that internal limit order price. This "inaccurate" price is returned because the place order endpoint is asynchronous, meaning the response is returned to you before the order is actually executed.

If you want the true execution price (execPrice) you should subscribe to the execution websocket.

How can I process WebSocket snapshot and delta messages?

Please refer to the orderbook topic's documentation.

Note that if you're using pybit, it handles these messages for you and always delivers a complete orderbook. Working code examples:

- Python:

_process_delta_orderbook()method within pybit (the Python SDK) - Node.js:

orderbooks, a library made by the creator of bybit-api (the Node.js SDK)

Why is my balance sufficient but withdrawal or transfer requests report insufficient balance?

Scenario Reproduction: when the master account encounters error code 131001 ("Withdrawal amount is greater than your available balance (XXXX USDT)") during withdrawal, or when transferring funds from a subaccount to the master account, encounters 131228 ("Your balance is not enough"), but calling Get All Coins Balance shows that transferBalance is sufficient.

/v5/asset/transfer/query-account-coins-balance?accountType=FUND

{

"retCode": 0,

"retMsg": "success",

"result": {

"memberId": "247200692",

"accountType": "FUND",

"balance": [

{

"coin": "BTC",

"transferBalance": "0.06",

"walletBalance": "0.06",

"bonus": ""

}

]

},

"retExtInfo": {},

"time": 1735189176388

}

Reason:

This occurs due to recent deposits to the master or subaccount, which lock the corresponding USD value. For example, 1 ETH was deposited into the master account 5 minutes ago and immediately traded into 0.05 BTC. However, due to the deposit risk not being fully released, this 0.05 BTC cannot be withdrawn. Similarly, if the deposit is made to a subaccount, the corresponding amount cannot be transferred to the master account.

Recommendation:

- If you need to confirm the available balance for withdrawal or transfer of a single currency, always use Get Single Coin Balance. Additionally, institutional loan accounts transferring out of risk unit may be affected by LTV and can use this API to query accurate transferable balances. See examples 4 and 5 below.

//Example 1: Query the withdrawal balance or transferable balance of a specific coin in a specific wallet of the current account.

GET /v5/asset/transfer/query-account-coin-balance?accountType=XXX&coin=XXX&withTransferSafeAmount=1

see field `transferSafeAmount`

//Example 2: Query the transferable balance of a specific coin to subaccounts or other wallets within the account.

GET /v5/asset/transfer/query-account-coin-balance?accountType=XXX&coin=XXX&withTransferSafeAmount=1

see field `transferBalance`

//Example 3: Use the master account to query the transferable balance of a specific coin in a specific wallet of a subaccount.

GET /v5/asset/transfer/query-account-coin-balance?memberId=XXX&accountType=XXX&coin=XXX&withTransferSafeAmount=1

-> transfer to other subaccounts or other wallets within the accounts: see field `transferBalance`

-> transfer to master account: see field `transferSafeAmount`

//Example 4: When transferring out of an institutional loan risk unit, the transferable balance under the LTV safety line (transfers within the account to funding wallets).

GET /v5/asset/transfer/query-account-coin-balance?withLtvTransferSafeAmount=1&accountType=UNIFIED&toAccountType=FUND&coin=XXX

see field `ltvTransferSafeAmount`

//Example 5: When transferring out of an institutional loan risk unit, the transferable balance under the LTV safety line (transfers to non-institutional loan accounts).

GET /v5/asset/transfer/query-account-coin-balance?withLtvTransferSafeAmount=1&toMemberId=XXX&accountType=UNIFIED&toAccountType=FUND&coin=XXX&

see field `ltvTransferSafeAmount`

- If you need to query the transferable balances of multiple coins simultaneously, use Get All Coins Balance. However,

if there are recent deposits, the returned

transferBalancefield will be less than or equal to the actual withdrawal or transferable balance to the master account. Additionally, for institutional loan accounts transferring out of risk units, the result may also be inaccurate. In such cases, refer to examples 4 and 5 in Recommendation 1.

//Example 1: Query the balance of all coins in the funding wallet of the current account (after January 9, 2025, querying all coins will no longer be supported, and the coin parameter must be provided).

GET /v5/asset/transfer/query-account-coins-balance?accountType=FUND

//Example 2: Query the balance of specific coins in the unified wallet of the current account (after January 9, 2025, up to 10 coins can be queried).

GET /v5/asset/transfer/query-account-coins-balance?accountType=UNIFIED&coin=USDT,ETH,BTC,USDC

//Example 3: Query the balance of specific coins in the unified wallet of a specified subaccount.

GET /v5/asset/transfer/query-account-coins-balance?memberId=XXX&accountType=UNIFIED&coin=USDT,ETH,BTC,USDC

- If you need to know whether the master account has any unresolved deposit risks, use Get Withdrawable Amount. Check the

limitAmountUsdfield:

GET /v5/asset/withdraw/withdrawable-amount?coin=XXX

-> If it equals 0, it indicates that all deposit risks have been released.

-> If it is not 0, it indicates that some assets, equivalent to the displayed USD value, still have unresolved risks.

Why can I not buy tokens/open positions/close positions/etc. on Testnet? Why do I encounter buy/sell: [1900000000000,44543000000] invalid (or similar) errors? Why are my market orders failing?

On cryptoexchanges, liquidity is required for trades to occur. For any purchase you want to conclude, there must be a corresponding seller, and vice versa. Market orders internally are IOC limit orders submitted at a much worse price. That internal price is calculated by our slippage limit.

Thus, if there are no opposite-sided orders in range [currentPrice; slippageLimitPrice] to fulfill your request, then your order placement will fail with the aforementioned error message.

Additionally, if there is insufficient liquidity in the range, your market order can be partially filled and then cancelled.

There is no guaranteed workaround. You can use GTC (Good Till Cancelled) limit orders to mitigate the risk of your order getting cancelled. Alternatively, you can use a more liquid environment, like Demo Trading on Production.

How can extend my API key without having to create a new one?

An API key created without binding IP address(es) will expire after 90 days. To avoid having to replace your API key and secret each time this happens:

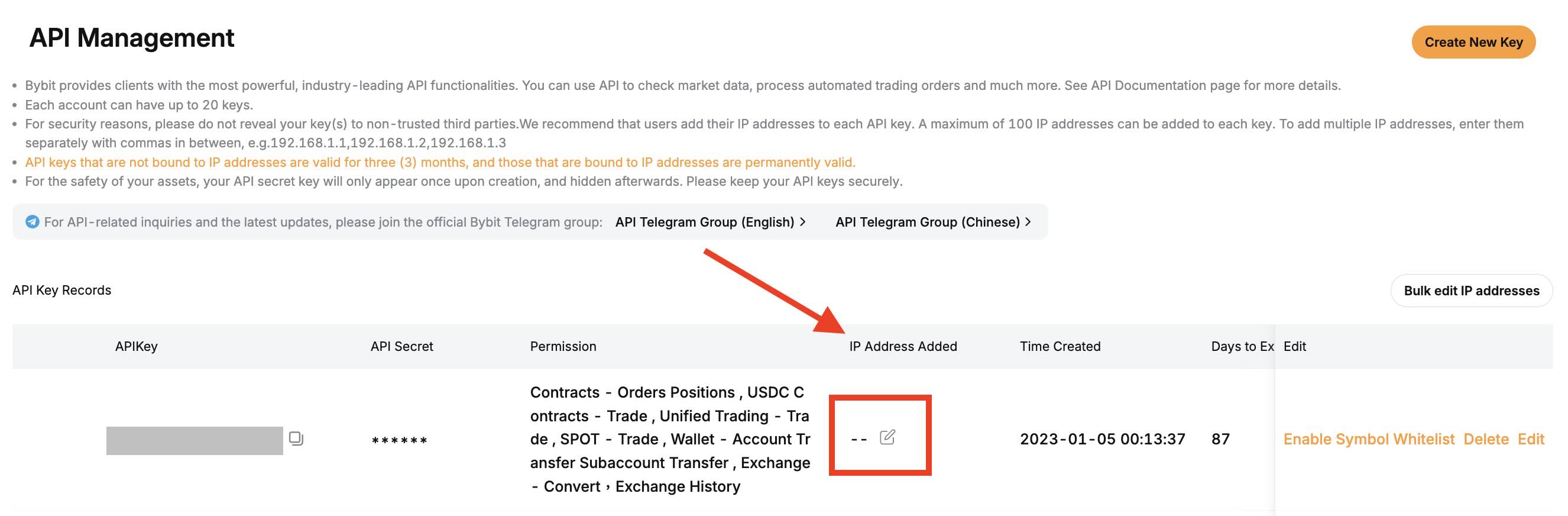

Navigate to the API key management page: https://www.bybit.com/app/user/api-management

Click on the edit button under the column "IP Address Added". A window will pop-up

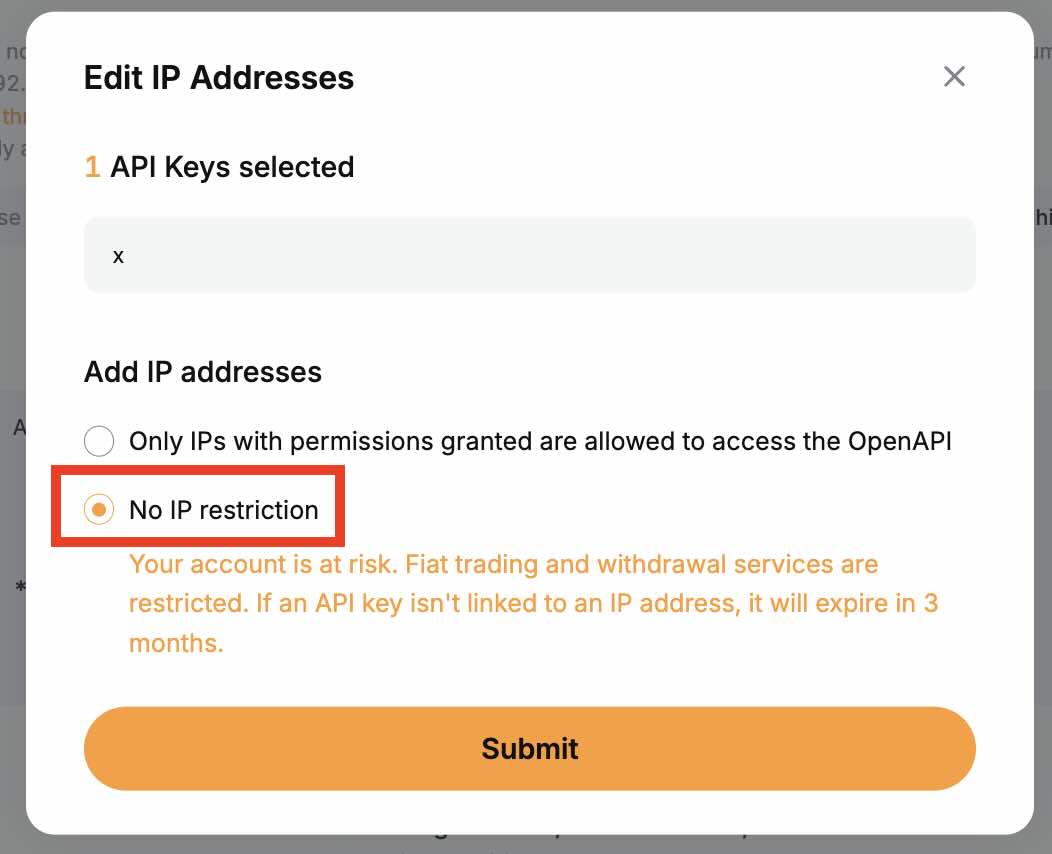

Select "No IP restriction" and click the "Submit" button

Enter your email and 2FA verification codes

Your API key's expiration has been extended to 90 days from now whilst keeping the same API key and secret.